The Crypto King

February 1, 2018

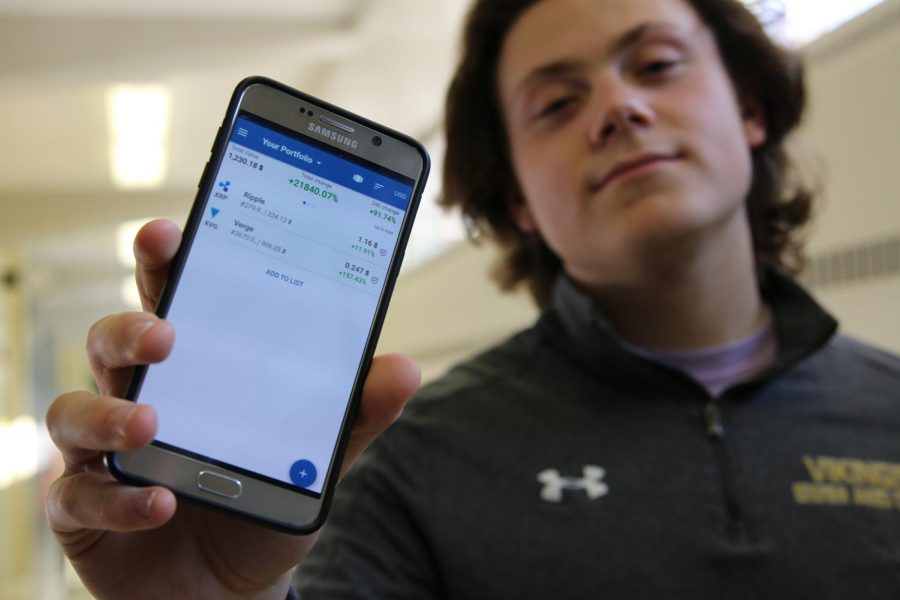

Senior David “Crypto King” Frohardt hunches over his laptop, giddily explaining how the price of Ripple is up 3 percent since this morning. To an average observer, Frohardt’s work could be taken for some confusing witchcraft. Instead, he’s a part of a 21st-century gold rush, investing in something known as cryptocurrency.

Cryptocurrency is a form of completely digital, unbacked currency that is highly volatile in price. This means it doesn’t come from any government, bank, company, or website. No one can just print more cryptocurrency, and no one verifies transactions.

Being completely virtual, there is no way to physically hold cryptocurrency or carry it around in a wallet. Instead, most people have a digital wallet, often times called their portfolio.

Unlike normal money, it isn’t typically used to purchase goods. However, that is looking to change. The idea of cryptocurrency is that there is a borderless, secure way to purchase goods internationally or locally without having to use traditional conversions or worry about some government watching every move. It is a bold dream, but one that is right now still limited.

However, it is already becoming more popular. Using some cryptocurrencies, everything from subway, coffee, and burger king to yachts, coffins, and plane tickets are possible to purchase in some locations. There are even debit cards made specifically for some cryptocurrency. But for the time being, cryptocurrency is treated more of as an investment to make money rather than something to actually use.

Having a currency which is entirely online raises a few questions. The forefront of these being: is it safe from hacking and where does it receive its value if it isn’t backed by some entity? The short answer to the former is yes. The answer to the latter is a complicated explanation.

To start, the first part of cryptocurrency, “crypto”, stands for cryptography. Cryptography is a section of mathematics and is the practice of, and study of, techniques to secure communication. This is the backbone of cryptocurrency. Security is such a vital part of cryptocurrency that it was included in its name. How it actually achieves its value and security is through cryptographic-based technology called blockchains and 256-bit encryption.

Truly understanding these two processes is way more than the majority of people need to actually know about in order to invest. For that reason, there won’t be an attempt to explain them. If interested, there are great online videos and articles from experts who could explain it better. What the average person does need to know is that it is an almost foolproof system, so investments won’t be hacked or mishandled anytime soon.

Having thrown the word cryptocurrency around every other sentence may have made it sound like it was a single thing. But just like how there isn’t only one currency, for example, there are dollars, pounds, euros, etc…, there isn’t just one kind of cryptocurrency.

In fact, there can be thousands of different “coins” at any given time. Most of these aren’t worth more than even a dollar. However, there are a few that have managed to become viable assets. The most popular and fastest growing of these few is called Bitcoin.

Bitcoin shot into the mainstream spotlight in 2017 when it’s value went up by over 1,000 percent. To illustrate how incredible of a change that is, imagine if someone were to have bought a Bitcoin on Jan. 5, 2017. It would’ve cost that person around $1,000. That might seem like a lot of money, but in comparison to the cost of a Bitcoin just eleven months later, it is nothing. That person’s same Bitcoin, which was worth only $1,000 in January, got up to be worth over $19,000 by December.

The volatility of the market, which affects all cryptocurrencies and not just Bitcoin, unfortunately, works both ways. The price for a Bitcoin can go from being worth $14,000 to $16,000 and then down to $11,000 in just a single day.

Of course, if the only way to get into Bitcoin was spending over $10,000, then no one would do it. The large majority of people only buy and sell parts of Bitcoins. However, even parts of Bitcoins can still be expensive. Frohardt owns a few dollars worth of Bitcoin, but he got into the crypto-trading game with other coins that were at the time inexpensive and lesser-known.

“I bought into these two cryptocurrencies primarily because they are actually cheap. I knew a little bit about them and I knew they seemed like they could be big one day,” Frohardt said.

Frohardt’s two biggest investments were in coins called Ripple and Verge. Since investing about a month and a half ago, Frohardt has had shocking success. A good deal of his money has come from his investment in Ripple, which peaked at profits of over 300 percent during his investment.

“So I put in $180 as my cryptocurrency investment. Again, cryptocurrencies are very volatile so [my profits] fluctuate, but right now it is at $1,200. It has gotten as high as $1,800 and as low as $600. ”

Putting $180 down on relatively unknown cryptocurrencies left many people doubting him.

“I think most people doubted it a little bit… the idea of investing in cryptocurrency. People thought it was maybe funny and were like ‘this is never gonna go anywhere’. There were a few people who believe in it. It seemed my parents were very skeptical at first about the situation…”

But his success was deafening, and he began to get attention. Not only were the doubters quelled, but his friends and family began wanting to invest as well. Since then, Frohardt has been teaching his friends how to invest wisely in the young and erratic crypto market.

“So when I actually started making my money, a thousand dollars profit, then people were like ‘you’re actually doing something right, and you only invested a month ago, how are you making so much gain?’ So they wanted in, and I thought that was really really cool.”

He’s earned the nickname of “Crypto King” among his investing apprentices, and rightfully so. Two of his earliest students have also developed investment portfolios to be proud of in the past month. These two students are seniors Chris Lipford and Mason McGinnis.

“I heard people talking trash on David and telling him how crypto was a waste of money, but I sat down and listened to everything he was saying and realized he really knew what he was talking about. So I got some advice from him and threw in 200 bucks,” Lipford said.

Throughout the process, Frohardt was a sage adviser.

“David was really helpful because buying crypto is kind of confusing. There’s a lot of different coins and the process of using a trading site and virtual wallet was tricky. Having someone who had done it before and knew some good coins to buy was great,” McGinnis said.

Both Lipford and McGinnis have seen their investments more than double in just around two weeks.

“I put in $180 and dispersed it among a lot of cryptocurrencies, but my combined portfolio is currently worth $400 or so,” Lipford said.

“I started with $100 and my portfolio has gotten all the way up to $270 at one point,” McGinnis said.

Despite all the success, Frohardt is still wary of the huge risks inherent in any investment, but especially cryptocurrency.

“The prices go up and down a lot, but maybe the biggest thing, compared to stocks and bonds, is that crypto has no government regulation. Crypto is a really young industry right now and there’s a chance you lose everything. That’s the first thing I tell anybody who wants to invest,” Frohardt said.

Several notable economists believe that cryptocurrency is a bubble. A bubble is when prices “get ahead of themselves” and shoot past the amount that a good is actually worth. Eventually, the bubble bursts and prices plummet back down. Given the sudden and monumental rise of coins like Bitcoin, it’s hard to say that prices will continue to rise or even hold its value in the future.

They often believe that once governments begin to regulate crypto, prices will sink; but crypto advocates and other experts say that as different coins continue to reduce transfer times, transaction fees, and energy consumption, then cryptocurrencies will grow more and more ubiquitous. Frohardt remains hopeful.

“I really have no idea how Ripple and Verge are going to do in the future, but I believe in them… I think [they] have a high chance of being something big,” Frohardt said.

While Frohardt has been successful trading, he cautions readers against thinking his story is typical.